Conic, a decentralized broker

"with great power comes great responsibility."

It's been a while, I was around and it made me want to give my opinion on a particular subject.

I discovered the idea of a decentralized broker in this article by Paul Frabot from Morpho. I think that term adequately sums up what Conic is all about. I'll let you read the paper and draw your own conclusions.

But I'm going to focus on something else here, which is an encrypted message left by Fiddy, a prominent member of the Curve ecosystem, in Conic's Discord.

Now that USDC/crvUSD and USDT/crvUSD pools are whitelisted for the USDC and USDT OPs respectively, it might be time to try and crack that message.

Alright, let's get into the fridge with smolting to think.

What tools do Conic have at its disposal to control the interest rate of crvUSD? I see two: yield and liquidity allocation weight (LAW).

And two decisive battlefields: the crvUSD and USDC Omnipools.

As a gentle reminder, the crvUSD OP provides liquidity but also selling pressure on crvUSD while the USDC and USDT OPs will bring buying pressure.

Let's look at the current context.

Curve’s stablecoin, crvUSD confirms the hopes placed in it with its up-only supply ($59.6m for now).

If this trend continues, it means that the borrowing rate will remain at relatively higher levels than other stable borrowing alternatives. Curve doesn't really want this as crvUSD is still in its bootstrapping phase.

So the interest rate must remain under relative control and not be dissuasive for potential new borrowers.

The premia can help us determine the level of overheating. This data represents the difference between the best crvUSD farming opportunity in the market and the interest rate. It is currently healthy at 10.56% for the wstETH market (15.7% - 5.1%). Unsurprisingly, the crvUSD OP offers the best yield for crvUSD.

As crvUSD is still in its infancy, it logically lacks profitable use cases. So the crvUSD supply increasing at good pace should result in more user actions like depositing wsETH > borrowing crvUSD > depositing in the crvUSD OP. Currently, 70.9% of the crvUSD supply lives in the crvUSD OP. The potential problem with this type of behavior is not even yield compression as Curve has the fuel to handle this, but rather selling pressure on crvUSD.

Indeed, ≈ 50% of the crvUSD deposited in the crvUSD OP are sold for the other stablecoins belonging to its whitelisted pools. More deposits therefore lead to more selling pressure, you know the song.

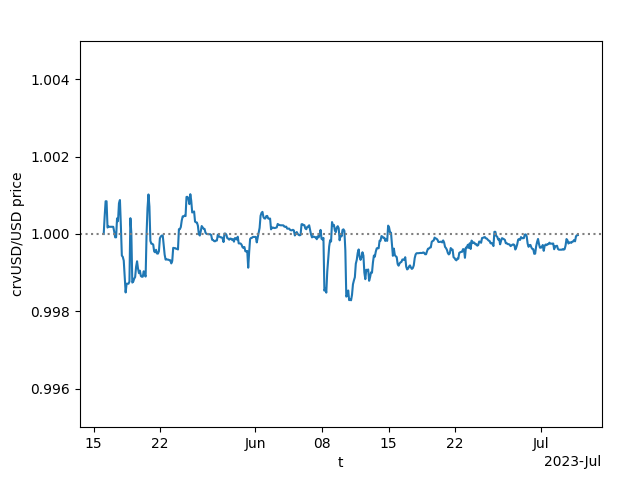

Selling pressure on crvUSD is not supposed to be an issue, but with peg keepers’ debt being one of the factors affecting the interest rate, this may result in a slightly different outcome. Under specific conditions of relatively persistent or insufficiently compensated selling pressure, not enough positions in soft liquidations and few use cases, the peg keepers' reserves may empty and struggle to replenish, leading to a rise in the interest rate supposed to incentivize borrowers to repay their loan. The peg keepers will arb the price increase created, potentially make a profit and replenish their reserves at the same time.

But what if borrowers don't have enough incentive to repay their loan despite the high interest rate? What if this high interest rate discourages potential borrowers in parallel? That’s kind of what's happening right now. The market is relatively bullish, borrowers and leveragors use a yield bearing collateral and are protected by crvUSD's brilliant liquidation mechanism. So for now crvUSD has to rely particularly on peg keepers and their reserves to counter selling pressure and stabilize the peg. So far it works very well.

But it would be better if crvUSD could count on external stablecoin liquidity to generate some buying pressure. Enter the USDC OP.

An increase in USDC/crvUSD LAW’s in the USDC OP > higher yield for the USDC OP > more USDC allocated to the USDC/crvUSD pool > increased buying pressure on crvUSD > more arbitrage opportunity for peg keepers when crvUSD>1$ > potential increase in their reserves (debt) > interest rate goes down > new users incentivized to borrow crvUSD. Good flywheel.

So Curve can actually use the crvUSD and the USDC OPs to influence the crvUSD’s interest rate.

If an interest rate reduction is desired, simply decrease the yield of the Curve pools and increase the USDC/crvUSD LAW’s in the USDC OP for instance. Some Conic LPs will flow from the crvUSD OP to the USDC OP to chase the higher yield on Conic and new users will be more incentivized to deposit in the latter.

Liquidity levels would be maintained through increased allocation and AMOs’ reserves would be regenerated. The interest rate would drop. “The show must go on.”

But there is a scenario where the show goes too far and the excess buying pressure from the USDC OP can no longer be mitigated by the borrowing/leverage. This would cause the peg keepers to reach their debt limit. If the low interest rate does not incentivize enough borrowers to arb, then Curve will have no better solution than to decrease the USDC/crvUSD’s LAW before deciding on the viability of increasing peg keepers’ debt ceilings.

As a result, some deposits should flow into the crvUSD OP. This should reduce the buying pressure on crvUSD, limiting supply expansion while exerting more selling pressure to allow peg keepers to reduce debt, and burn some crvUSD on the way. The Force rebalances, the interest rate goes up. The premia should decrease, discouraging new users. In my opinion, this is not a bad thing at this stage as the supply would have grown faster than expected and a higher interest rate will be profitable for Curve (revenue) as a sticky base of borrowers is willing to pay quite a bit to borrow crvUSD. Obviously, the yield will have to hold up, but we all know who is in charge of the incentive policy.

When a new wave of DeFi users join in to benefit either from an increase in the yield of crvUSD, to use leverage or whatever, Curve will know how to make its interest rate attractive for them while absorbing the resulting selling pressure.

A message to vlCNC holders, with great power comes great responsibility.